The stock market spent most of the session chopping around until taking a sharp turn lower mid-afternoon after President Trump said the White House would not take up stimulus negotiations until after the Nov. 3 election. The announcement came as Fed Chair Jerome Powell earlier in the day underscored the risk to the economic recovery if Congress doesn’t agree to more fiscal aid.

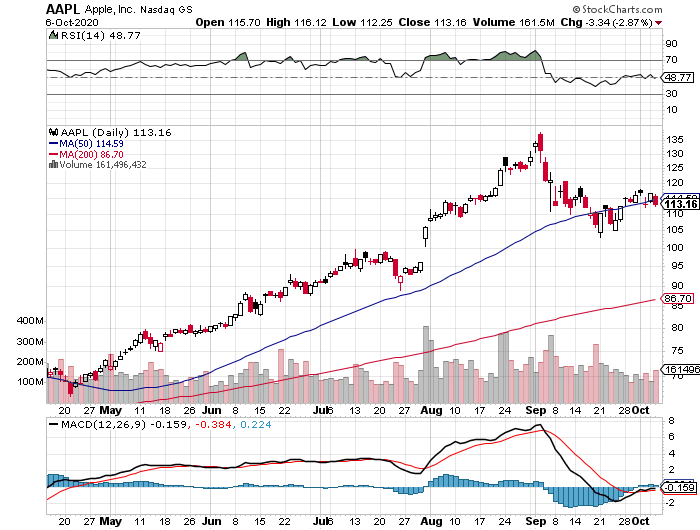

In the previous session, stock of Apple Inc. (AAPL) opened at $115.70 and last traded at $112.90 x 900. More than 161,498,212 shares exchanged hands compared to an average daily volume of 171,056,316 shares. At the current pps, the market capitalization stands at 1.935T.

Strong Fundamentals Ahead Of Iphone Release

Investors try to use stocks with high beta values to quickly recoup their investments after sharp market losses. Apple Inc. (AAPL) currently has a Beta value of 1.17 . Beta is a measurement of a stock’s price fluctuations, which is often called volatility and is used by investors to gauge how quickly a stock’s price will rise or fall. A stock with a beta of greater than 1.0 is riskier and has greater price fluctuations, while stocks with beta values of less than 1.0 are steadier and generally larger companies.

Beta is often measured against the S&P; 500 index. An S&P; 500 stock with a beta of 2.0 produced a 20 percent increase in returns during a period of time when the S&P; 500 Index grew only 10 percent. This same measurement also means the stock would lose 20 percent when the market dropped by only 10 percent.

Next, let’s take a look at Apple Inc current P/E ratio. Apple Inc. (AAPL) currently has a PE ratio of 34.33. PE ratio is an important parameter to look at when trading a stock mostly because it is easy to calculate. There are a couple of ways to calculate PE ratio either by dividing share price by earnings per share or dividing the market cap by net income.

It is important to note that the earnings are usually taken from the trailing twelve months (TTM). Nevertheless, P/E tells us how much an investor is willing to pay for $1 of a company’s earnings. The long-term average P/E is around 15, so on average, investors are willing to pay $15 for every dollar of earnings. Another useful way to look at this: Turn the P/E ratio around to look at the E/P ratio, which when expressed as a percentage gives us the earnings yield. For instance: 1/15 gives us an earnings yield of 6.67%.

While we have already looked at Apple Inc beta and P/E ratio, the EPS cannot be ignored. Apple Inc EPS for the trailing twelve months was 3.30. Traders and investors often use earnings per share (TTM) to determine a company’s profitability for the past year. So in essence, EPS is the amount of a company’s net income per share of common stock. Earnings per share equal the company’s net income less any dividends paid on preferred stock divided by the weighted average number of common stock shares outstanding during the year.

Technical chart:

The Analyst Chirp:

Apple Inc. (AAPL) has received an average target price from analysts of $119.92 amounting to a recommendation rating of Overweight. That comes from 40 different analysts. Perhaps, the driver for that assessment comes from the company’s valuations. Drilling down a bit further, this quarter, we are looking at an average estimate from analysts for earnings per share level of 34.00. That shift to 30.00 heading into next quarter.

So whats the buzz ?

As per the recent press release: Apple® will launch the Apple Store® online in India on September 23, offering Apple’s full range of products and support directly to customers across the country for the first time. The new online store will provide customers with the same premium experience found in Apple Store locations around the world, delivered by online team members who are ready to offer their expertise.

Its important to take a look at the institutional holding in a stock as their next move is to tout the company’s merits and drive interest in the stock and cause a increase in pps. The major holders so far as as follows: 0.07% of Shares Held by All Insider, 62.12% of Shares Held by Institutions, 62.16% of Float Held by Institutions, 4,296 Number of Institutions Holding Shares.

The top 5 institutional holders are as follows: Vanguard Group, Inc. (The) – 1,315,961,000, Blackrock Inc. – 1,101,824,048, Berkshire Hathaway, Inc – 980,622,264, State Street Corporation – 709,057,472, FMR, LLC – 383,300,188.