RedHawk Holdings Corp. (OTCMKTS:SNDD), Petroteq Energy Inc. (OTCMKTS: PQEFF), and Allied Energy Corporation (OTCMKTS:AGYP)

Oil stocks are in focus as oil prices climbed past the psychological $70 per barrel benchmark. The summer driving season kicked off in the U.S. over Memorial Day weekend amid rising Covid-19 vaccination rates. European lockdowns have eased as countries prepare to open up for vacationed tourists.

OPEC+ agreed on June 1 to continue its plan to slowly increase oil supply on the increased demand signals.

Investors need to be cautious that while oil prices have risen recently, Covid-19 cases are still climbing in Asia and South America. But for reference purposes here are the top stocks involved in U.S. shale as of June 1.

When the trading public focuses on an industry, sometimes the biggest gainers can be found on the OTC markets. While the stocks are risky investments, they are certainly worth radaring for trading opportunities.

RedHawk Holdings Corp. (OTCMKTS:SNDD) recently reported their third quarter numbers, which weren’t all that great, including a net loss from operations of $425,479 for the nine month period ended March 31, 2021 on gross revenues of $867,841. Net of distributor and introductory discounts of $177,095, net revenues for the nine month period ended March 31, 2021 were $690,746. For the trailing twelve month period ended March 31, 2021, RedHawk reported a net loss from operations of $211,986 on gross revenues of $1,831,297, and net revenues of $1,606,035.

Petroteq Energy Inc. (OTCMKTS: PQEFF) a fully integrated clean technology company focused on the development and implementation of new proprietary oil extraction and remediation technologies, has been in the news recently based on a potential buyout from an unnamed German investor. The company is up quite a bit from its .045 low currently trading around 15 cents, and seeing higher than normal trading activity. It is worth keeping an eye on.

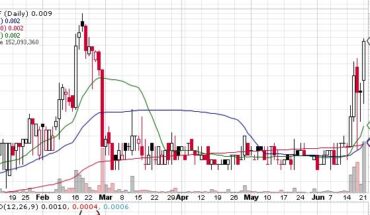

Allied Energy Corporation (OTCMKTS:AGYP) recently reported news of several new wells, and combined with the positive news in the oil industry could see a short squeeze. The company is down 50% from its highs and there is a decent-sized short position reported by the OTCshortreport. If AGYP sees any buying pressure, things could get interesting.