With less big money coming into traditional oil exploration, causing supply shortages, oil prices are rising. As the prices per barrel rise, the exploration business will become more lucrative, meaning oil stocks could still see upside ahead.

The surging price of oil has lifted share values across the industry with several ETFs outperforming expectations. Momentum continues to build and there are several opportunities in the sector you should put on your watchlist today.

Vermillion Energy, Inc. (NYSE:VET) is an exploration company that is producing oil already in Europe, North America, and Australia. This diversification across continents is advantageous as a hedge against unforeseen geopolitical events. Currently the company is focusing on efficiency, essentially to create greater value for shareholders. As some analysts have Vermillion “overvalued” these strides towards efficiency could turn the narrative. Keep an eye on this one currently near it’s YTD high it could pivot soon.

Vermillion being a VETeran in the space, NextDecade Corporation (Nasdaq:NEXT) is what investors may be looking to next.

The stock took off making investors nearly 60% on Tuesday after several Wall Street analysts upgraded the small cap stock. Evercore ISI, tripled their price target on NextDecade’s stock to $9 per share which even with Tuesday’s gains leaves quite a bit of room for investors to make bank.

While the fundamentals are moving NEXT, many traders will see rising oil prices and look for favorable technical setups.

There are a couple oil stocks under a dollar with charts setting up nicely.

Borr Drilling Limited (NYSE:BORR) has been raising funds, $57.5 million from two separate offerings. In addition, the company raised another $46 million in Jan. 2021. This could mean there may be a catalyst in the near future. Purely speculation, but this is why it’s on my watchlist. If BORR starts moving it could climb back to it’s YTD high of $1.56 and from the current price of $0.93 that’s not a bad target.

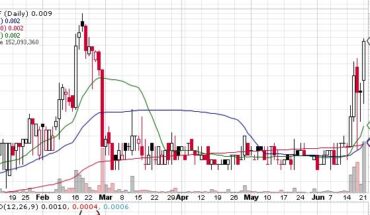

Allied Energy Corporation (OTCMKTS:AGYP) is actually in a much more favorable position as the company has 4 projects in process, and has recently tweeted updates leading investors to believe more information could be on the way.

The stock found support around 25 cents, bounced hard, and made a quick 40% before pulling back. The stock continues to build a following and is worth putting on the radar.