DavidsTea Inc (NASDAQ:DTEA) is trading weak in the pre-market session after soaring about 22% in the past week.

Major Trigger:

DAVIDsTEA Reports First Quarter Fiscal 2021 Financial Results

Key Highlights:

- Sales for the three-months ended May 1, 2021 decreased 27.9%, or $9.0 million, to $23.2 million from $32.2 million in the prior year quarter.

- Gross profit of $10.8 million for the three-months ended May 1, 2021 decreased by $3.9 million or 26.6% from the prior year quarter due primarily to a decline in sales during the period. Gross profit as a percentage of sales increased slightly to 46.3% for the three-month period ended May 1, 2021 from 45.5% in the prior year quarter.

- Net income was $3.2 million in the quarter ended May 1, 2021 compared to a Net loss of $45.8 million in the prior year quarter.

- Fully diluted earnings per common share was $0.12 in the first quarter ended May 1, 2021 compared to a loss per common share of $1.76 in the prior year first quarter.

- EBITDA, which excludes non-cash and other items in the current and prior periods, was $4.1 million in the quarter ended May 1, 2021 compared to a negative $40.4 million in the prior year quarter representing an improvement of $44.5 million over the prior year quarter.

Market Reaction

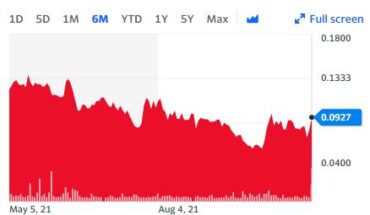

As of 6:41, DTEA stock fell 7.91% to $4.89 with 300 shares traded hands.