Earlier on this month, Nevada based VisualMED Clinical Solutions Corp (OTCMKTS:VMCS) signed an agreement with Renova Health Inc by way of which two of the latter’s business divisions were going to be merged with VisualMED.

The announcement had been made back on June 3 but it seems that the development has not been welcomed by any enthusiasm by investors. On Thursday, the VisualMED stock fell by as much as 45% and it is going to be interesting to see if the slide is arrested today.

As per the provisions of the agreement, two divisions of Renova Health, Advanced Molecular Services Group Inc and Health Technology Solutions Inc, are going to be merged with VisualMED. Once the transaction is closed, both those divisions are going to be operated as fully owned subsidiary companies. In addition to that, VisualMED will also need to send in the necessary filings to the OTC Markets and become fully compliant before the transaction can be completed.

Market Reaction:

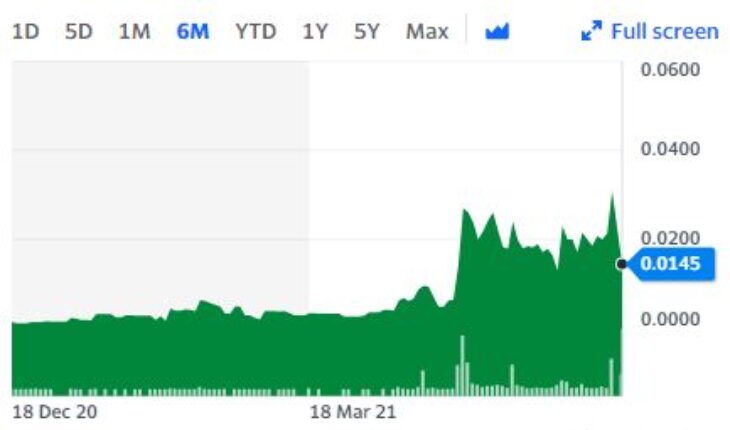

On Thursday, VMCS stock slumped by 45.28% to $0.0145 with more than 28.16 million shares, compared to its average volume of 8.95 shares. The stock has moved within a range of $0.0142 – 0.0203 after opening the trade at $0.0202. Over the past 52-week, the stock has been trading within a range of $0.0011 – 0.0495.

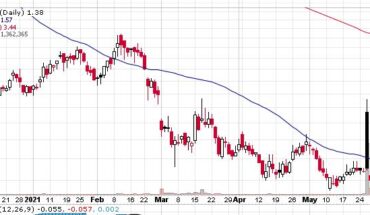

Moving Averages

| +/- EMA(20) | 177.13 (-6.26%) |

| +/- SMA(50) | 180.44 (-7.97%) |

| +/- SMA(200) | 156.54 (+6.08%) |

Pivot Points

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 0.0063 | 0.0102 | 0.0124 | 0.0163 | 0.0185 | 0.0224 | 0.0246 |

| Fibonacci | 0.0102 | 0.0126 | 0.0140 | 0.0163 | 0.0187 | 0.0201 | 0.0224 |

| Camarilla | 0.0128 | 0.0134 | 0.0139 | 0.0163 | 0.0151 | 0.0156 | 0.0162 |

| Woodie | 0.0110 | 0.0126 | 0.0171 | 0.0187 | 0.0232 | 0.0248 | 0.0294 |

| DeMark | – | – | 0.0113 | 0.0163 | 0.0174 | – | – |