CytRx Corporation (OTCMKTS:CYTR) plunged 62% after the company announced that the FDA had issued Orphazyme (NASDAQ: ORPH) with a Complete Response Letter following NDA for arimoclomol review. Arimoclomol is a heat shocker amplifier for Niemann-pick disease type C treatment.

According to Orphazyme, they received the CRL because the FDA needed more evidence to establish the interpretation and 5-domain NPC Clinical Severity Scale’s (“NPCCSS”) validity, particularly its swallow domain. In addition, the FDA stated in the letter that more data is needed to supplement confirmatory evidence outside the Phase 2/3 study to validate the NDA’s benefit-risk evaluation.

Christopher Bourdon, the CEO of Orphazyme, said they are disappointed by the FDA review’s outcome considering the vital requirement for a new NPC therapeutic alternative. Still, the company will cooperate with regulators to deliver the therapy. He said they are focusing on EU approval and expect CHMP opinion in Q4 2021 with Marketing Authorization expected in the first quarter of 2022. So in the coming months, CYTR is a stock to watch.

Market Reaction:

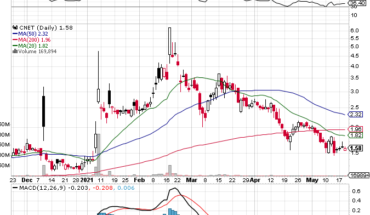

On Friday, CYTR stock plunged by 61.70% to $1.08 with more than 3.29 million shares, compared to its average volume of 313k shares. The stock has moved within a range of $1.0800 – 1.5000 after opening the trade at $1.27. Over the past 52-week, the stock has been trading within a range of $0.3900 – 5.0000.

Pivot Points

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 0.5200 | 0.8000 | 0.9400 | 1.2200 | 1.3600 | 1.6400 | 1.7800 |

| Fibonacci | 0.8000 | 0.9604 | 1.0596 | 1.2200 | 1.3804 | 1.4796 | 1.6400 |

| Camarilla | 0.9645 | 1.0030 | 1.0415 | 1.2200 | 1.1185 | 1.1570 | 1.1955 |

| Woodie | 0.6400 | 0.8600 | 1.0600 | 1.2800 | 1.4800 | 1.7000 | 1.9000 |

| DeMark | – | – | 0.8700 | 1.2200 | 1.2900 | – | – |

Moving Averages

| +/- EMA(20) | 2.15 (-49.77%) |

| +/- SMA(50) | 2.00 (-46.00%) |

| +/- SMA(200) | 1.76 (-38.64%) |