Rolls-Royce Holdings PLC (OTCMKTS:RYCEY) is planning to create new net-zero emissions products by 2030. In addition, the company is accelerating its race towards a zero-carbon economy. The jet engine maker has already set goals to set the foundation to enable significant global economy elements to be net-zero by 2050.

According to the company, all in-production civil aircraft engines will be 100% sustainable aviation fuel compatible by 2023. Rolls-Royce also plans to devote 75% of its gross research and development spending to lower carbon and net-zero technology by 2025. By 2030, it targets new power systems to emit 35% less over their lifetime 2030.

CEO Warren East said that with the world merging from the pandemic, economic growth could be net-zero carbon future compatible. He said that at Rolls-Royce, they believe in the promising and transforming potential of tech. He said that they pioneer power vital in the successful function of the world and address the climate crisis power has to be net-zero carbon emissions compatible. In the coming years, Rolls-Royce is a stock to watch.

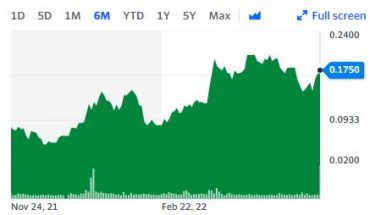

Market Reaction:

On Friday, RYCEY stock fell by 2.53% to $1.54 with more than 4.82 million shares, compared to its average volume of 4.82 million shares. The stock has moved within a range of $1.5100 – 1.5500 after opening the trade at $1.53. Over the past 52-week, the stock has been trading within a range of $1.3100 – 4.0900.

Pivot Points

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 1.4767 | 1.4933 | 1.5167 | 1.5333 | 1.5567 | 1.5733 | 1.5967 |

| Fibonacci | 1.4933 | 1.5086 | 1.5181 | 1.5333 | 1.5486 | 1.5581 | 1.5733 |

| Camarilla | 1.5290 | 1.5327 | 1.5363 | 1.5333 | 1.5437 | 1.5473 | 1.5510 |

| Woodie | 1.4700 | 1.4900 | 1.5100 | 1.5300 | 1.5500 | 1.5700 | 1.5900 |

| +/- EMA(20) | 1.55 (-0.65%) |

| +/- SMA(50) | 1.50 (+2.67%) |

| +/- SMA(200) | 1.91 (-19.37%) |