The Idera Pharmaceuticals (NASDAQ:IDRA) stock has been in considerable focus among investors this week and it might be a good idea for investors to take a look at the price action in the stock.

Back on Tuesday, the Idera stock had emerged as one of the major gainers having surged by as much as 45% after investors piled on it. However, it was a different story on Wednesday. Yesterday, the stock actually went down by 13% since investors decided to take some of the profits that had been generated.

The recent rally in the stock was triggered after it a filing with the United States Securities and Exchange Commission revealed that an insider in the company had purchased the Idera stock. Daniel Soland, who is the Chief Operating Officer in Idera, picked up as many as 5000 shares in the company at $1.19 per share and took his total holdings to 78843 shares.

Earlier in the month, it had been revealed that the Chairman of the Idera Board, Michael Dougherty had also acquired 85000 shares for $1.19 each. Insider share purchase is often an indication that the company’s top executives are bullish about the future of the business and hence, it often leads to bullish moves.

Market Reaction:

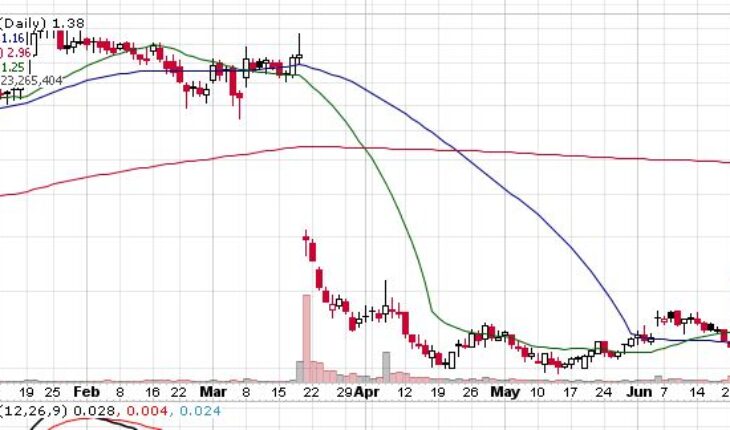

On Wednesday, IDRA stock fell 12.66% to $1.38 with more than 23.11 million shares, compared to its average volume of 3.05 million shares. The stock has moved within a range of $1.3100 – 1.7100 after opening the trade at $1.58. Over the past 52-week, the stock has been trading within a range of $0.9700 – 6.1400.