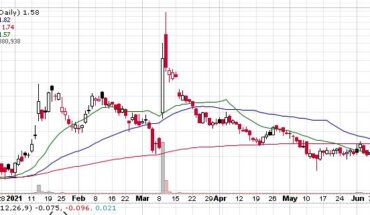

Globus Maritime Limited (NASDAQ:GLBS) slumped 27% after announcing a securities purchase arrangement with some unassociated institutional investors. As per the agreement, the company will issue around 10 million of its common shares as well as purchase warrants to the investors to acquire around 10 million common shares at $5 pershare.

The option is exercisable straightaway with an expiry of five and half years from the date of share issuance. Gross proceeds from the share offering will be around $50 million before subtracting agent fees and offering expenses.

The company expects the offering to close by June 29, 2021. Also, the company announced that it secured new charter employment for the M/V River Globe vessel. Already the vessel has been chartered for a gross daily rate of $29,500 to an unrelated party. The charter, which commenced on June 21, will run for a minimum of three months to five months included an option for additional 15 days.

The company continues to experience a strong market, and in the coming days, GLBS will be a stock watch.

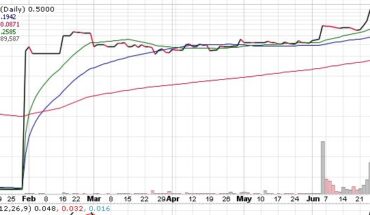

Market Reaction:

On Friday, GLBS stock slumped 26.50% to $4.07 with more than 13.93 million shares, compared to its average volume of 838k shares. The stock has moved within a range of $3.9150 – 4.1600 after opening the trade at $4.09. Over the past 52-week, the stock has been trading within a range of $ 3.8600 – 28.0000.