Grom Social Enterprises Inc (NASDAQ:GROM) had a great move on Friday as the stock closed higher by 25% on unusual volume. The stock has gained 80% so far this year.

Major Trigger:

Last Week – Grom Social Enterprises, Inc. Announces Closing of $10.0 Million Public Offering

Key Highlights:

- GROM announced the closing of its previously announced underwritten public offering of 2,409,639 units at a public offering price of $4.15 per unit for aggregate gross proceeds of approximately $10.0 million prior to deducting underwriting discounts, commissions, and other offering expenses.

- Each unit issued in the offering was comprised of one share of common stock and one warrant to purchase one share of common stock. Each warrant is exercisable for one share of common stock at an exercise price of $4.565 per share and will expire five years from issuance.

- In addition, the Company granted the underwriters a 45-day option to purchase up to an additional 361,445 shares of common stock and/or warrants to purchase up to 361,445 shares of common stock at the public offering price less the underwriting discounts and commissions. The common stock and warrants began trading on the Nasdaq on June 17, 2021 under the symbols “GROM” and “GROMW”, respectively.

- EF Hutton, division of Benchmark Investments, LLC, acted as sole book-running manager and Revere Securities LLC acted as co-manager for the offering.

Market Reaction:

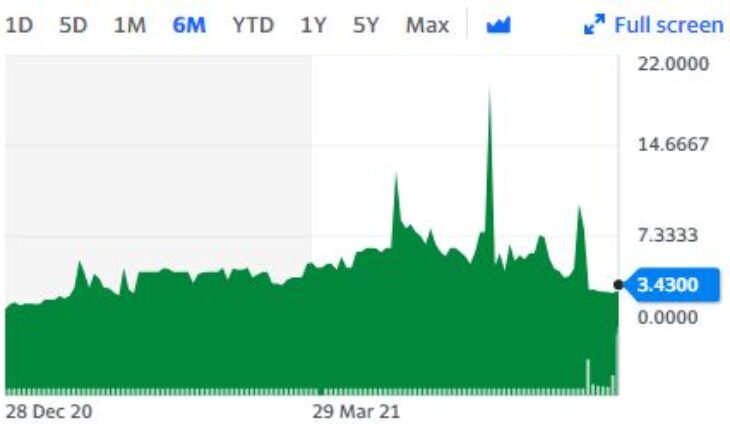

On Friday, GROM stock moved up 24.73% to $3.43 with more than 4.69 million shares, compared to its average volume of 147K shares. The stock has moved within a range of $2.7600 – 4.0800 after opening the trade at $2.92. Over the past 52-week, the stock has been trading within a range of $0.9920 – 19.5000.