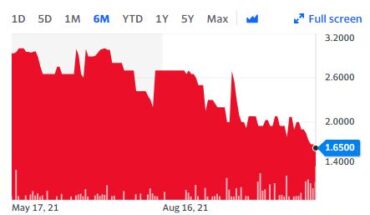

Qumu Corp (NASDAQ:QUMU) was one of the biggest losers in Wednesday’s trading session after the company provided key updates to shareholders.

Market Action

On Wednesday, QUMU stock slumped 25% to $2.88 with more than 1.30 million shares, compared to its average volume of 259k shares. The stock has moved within a range of $2.8100 – 3.2900 after opening the trade at $3.26.

Major Trigger:

Qumu Reports Preliminary Second Quarter 2021 Financial Results and Updates 2021 Business Outlook

Key Highlights:

- Based on preliminary unaudited results, the Company expects revenue for Q2 2021 to range between $5.7 million and $5.9 million. This compares to revenue of $9.3 million in Q2 2020 and $5.8 million in Q1 2021.

- Subscription, maintenance, and support revenue for Q2 2021 is expected to range between $4.9 million and $5.1 million. This compares to subscription, maintenance, and support revenue of $4.7 million in Q2 2020 and $5.0 million in Q1 2021.

- Subscription annual recurring revenue (ARR) is expected to range between $12.0 million and $12.2 million for Q2 2021, compared to $9.7 million in Q2 2020 and $11.9 million in Q1 2021.

- Gross margin for Q2 2021 is expected to range between 72.5% and 73.5%. This compares to 68.5% in Q2 2020 and 73.1% in Q1 2021.

- Net loss for Q2 2021 is expected to range between $(4.9) million and $(4.3) million as compared to net loss of $(692,000) in Q2 2020 and $(4.5) million in Q1 2021. Adjusted EBITDA loss, a non-GAAP measure, for Q2 2021 is expected to range between $(5.1) million and $(4.8) million. This compares to adjusted EBITDA of $809,000 in Q2 2020 and adjusted EBITDA loss of $(4.1) million in Q1 2021.