Grom Social Enterprises Inc. (NASDAQ:GROM) is up 73% year to date. Recently the company announced the closing in an underwritten public offering of 2.41 million units at $4.15 per unit for a total proceed of around $10 million before accounting for underwriting commissions, discounts, and offering expenses.

The company has given underwriters a 45-day option to buy 361,445 units at the public offering price. Each unit comprises a common share and a warrant to acquire one common share, with each warrant excisable at $4.565 for each common share, and they have a term of five years from the date of issuance. The offering closed on June 21, 2021.

Following the public offering, Grom received approval for listing its common shares and warrants on the Nasdaq Capital Market. The common shares will be traded under the ticker symbol “GROM,” with warrants trading under the “GROMW.” The stock commenced trading on June 17, 2021, on the Nasdaq Capital Market. With the stock now listed on the Nasdaq Capital Markets, GROM will be worth watching in the coming months.

Market Reaction:

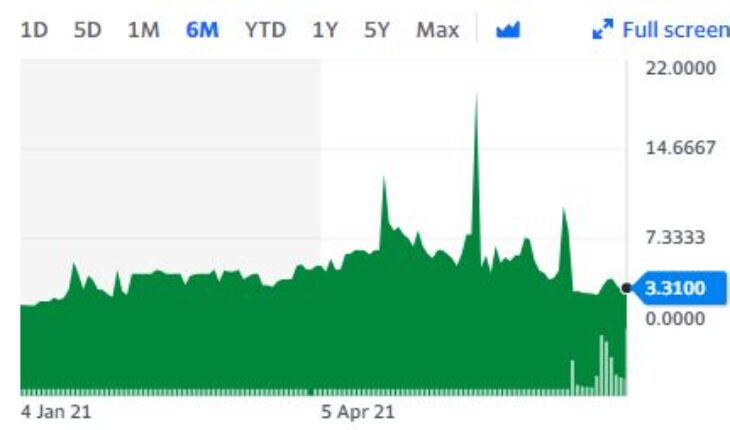

On Friday, GROM stock went up 4.75% at $3.31 with more than 871k shares, compared to its average volume of 307k shares. The stock had moved within a range of $2.9600 – 3.4000 after opening the trade at $3.08. Over the past 52-week, the stock has been trading within a range of $ 0.9920 – 19.5000.