Humbl Inc. (OTCMKTS:HMBL) dropped 7% after announcing the retirement of 9,350 Series B Preferred Stock that its CEO Brian Foote owns. The shares are equivalent to 93.5 million common stock shares. The share’s market value based on the closing share price in the previous day was $100 million.

Previously, Foote had retired around 551.67 million shares of pre-split common stock from the November 2020 float at a personal cost. The retirement seeks to reduce its overall share count and protect investors from dilution as HYMBL pursues its topline revenue, market stock acquisition strategies, and brand partnerships.

Recently, HYMBL completed Monster Creative LLC’s acquisition for a total consideration of $8 million. The company paid the purchase price through convertible debt worth $7.5 million and $0.5 million in non-convertible debt. Notably, the convertible debt conversion price was $1.2 per share. Monster Creative is a Hollywood advertising agency founded by Kevin Childress and Doug Brand. So in the coming months, HMBL is a stock to watch.

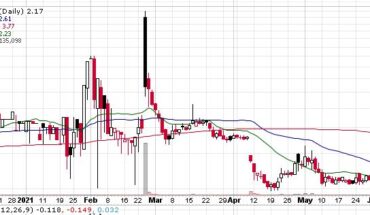

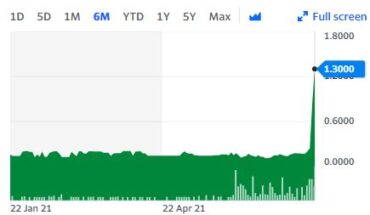

Market Reaction:

On Friday, HMBL stock fell 6.67% at $1.05 with more than 4.52 million shares, compared to its average volume of 11.65 million shares. The stock had moved within a range of $1.0300 – 1.1400 after opening the trade at $1.12. Over the past 52-week, the stock has been trading within a range of $0.0002 – 7.7200.