Investors are expected to watch the OptimumBank Holdings Inc (NASDAQ:OPHC) stock quite closely this morning considering the fact that the stock had declined by as much as 6% last Friday. Hence, it might be the right time to take a closer look at the stock.

There was no news about the company last week that might have led to the selloff on Friday, however, back on June 7 the company had announced the launch of a private offer. The private offer was meant for exchanging the outstanding Trusted Preferred Securities in OptimumBank. The whole transaction was to be conducted as per the provisions that had been laid out in the confidential offering memorandum.

At the time, OptimumBank also announced that the exchange offer was going to expire on the next day, unless otherwise stated by the company. On the other hand, investors also need to know that under the terms of this offer, the company also revealed that it was going to issue shares of the common stock, valued at $0.01 each, for the Trusted Preferred Shares. It is unlikely that this transaction was responsible for the decline in the share price last Friday but it is something that investors ought to know about.

Market Reaction:

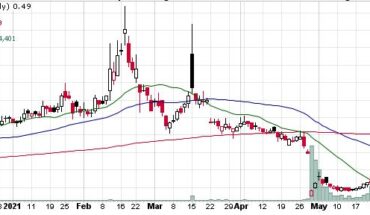

On Friday, OPHC stock fell 6.50% at $5.05 with more than 324k shares, compared to its average volume of 103k shares. The stock had moved within a range of $4.96 – 5.83 after opening the trade at $5.78. Over the past 52-week, the stock has been trading within a range of $2.10 – 6.19.