Siebert Financial Corp (NASDAQ:SIEB) dropped 1% on Friday. The company recently announced promising Q1 2021 financial results in which revenue was up 28% YoY to $18.9 million. Equally, the company reported an operating income of $3 million with diluted and basic earnings per share of $0.07. Siebert board member and shareholder Gloria E.

Gebbia said they are delighted with the solid start for 2021. She said that the company’s strategic initiatives and acquisitions were vital in driving the company’s growth and impacting the bottom line. Gloria added that Siebert’s core business areas and personnel investment helped the company yield positive results and offset any revenue reduction associated with low interest rates.

The company’s Securities Finance Group posted $1.8 million in revenue, topping its record quarterly revenue because of stock loan functions expansion and onboarding of significant personnel. Siebert also implemented cost-saving measures, including occupancy expenses reduction, which has started impacting its bottom line. So, in the coming months, SIEB is a stock to watch.

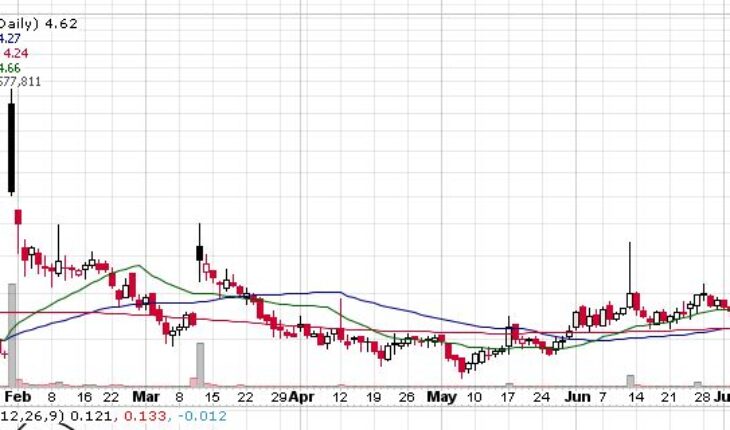

Market Reaction:

On Friday, SIEB stock fell 11% at $4.62 with more than 577K shares, compared to its average volume of 301k shares. The stock had moved within a range of $4.5001 – 5.0499 after opening the trade at $5.04. Over the past 52-week, the stock has been trading within a range of $3.1300 – 18.5000.