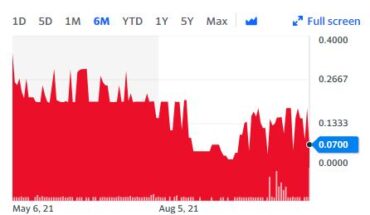

After a stock manages to record massive gains over an extended period of time, it is almost inevitable that a correction is going to take place and that is what happened with the Dark Pulse (OTCMKTS:DPLS) stock this past Friday.

Last Friday the stock declined by as much as 20% but despite that it should be noted that it is still up by 150% over the course of the past month. The one important development regarding the company last week was the appearance of its Chief Executive Officer Dennis O’Leary in The Stock Day Podcast. It is a popular podcast and O’Leary spoke at length about the different aspects of the company.

One of the first things that O’Leary addressed was the company’s decision to waive the salaries of both the member of the board and that of the management as well. He stated that the decision to do that was in line with Dark Pulse’s decision to run a lean as well as efficient operation. He went on to state that at this point, the company is looking into the possibility of making a few more acquisitions and eventually turn into a SaaS or software as a service firm.

Market Reaction:

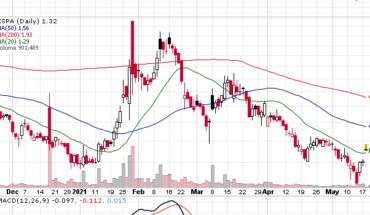

On Friday, DPLS stock fell 9% at $0.1470 with more than 88.31 million shares, compared to its average volume of 98.36 million shares. The stock had moved within a range of $0.1420 – 0.1749 after opening the trade at $0.17. Over the past 52-week, the stock has been trading within a range of $0.0001 – 0.2020.