In recent times, the shares of the mortgage company Federal National Mortgage Association or Fannie Mae (OTCMKTS:FNMA) have recorded considerable losses and over the course of the past month alone, it has recorded losses of 40%.

The stock entered into a downward spiral after portions of a case that could have brought back billions of dollars worth of profit for the shareholders was dismissed by the United States Supreme Court. The company had been put into government conservatorship after Fannie Mae, along with Freddie Mac, had taken as much as $187 billion from the United States Treasury.

The agreement had initially stipulated the two to make fixed interest payments but eventually it was amended and the two entities were meant to make the payments through the entirety of their profits.

However, in the lawsuit, shareholders claimed that the two banks handed over more than they had actually owed and the actual figure was quoted as $124 billion. However, the claim was dismissed and it was no surprise that it came as a big of a shock for the Fannie Mae shareholders. That is possibly the main reason behind the steady decline in the Fannie Mae stock over the course of the past month.

Market Reaction:

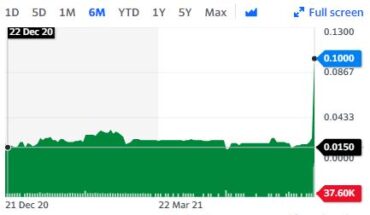

On Friday, FNMA stock fell 1.50% at $1.32 with more than 4.29 million shares, compared to its average volume of 6.63 million shares. The stock had moved within a range of $1.3100 – 1.3500 after opening the trade at $1.33. Over the past 52-week, the stock has been trading within a range of $1.2300 – 3.2500.