Data Storage Corporation (NASDAQ:DTST) jumped 19.62% after announcing the signing of a securities purchase agreement with some accredited investors to buy around $8.3 million worth of its common stock shares in a registered direct offering. The agreement also includes warrants purchase to acquire the company’s common shares in a concurrent at the market priced private placement as per the Nasdaq rules. The combined buying price for the common shares and 0.75 warrants is around $6.04.

According to the agreement terms, the company has agreed to sell 1.375 million common shares and warrants to acquire up to 1.032 million of its common shares. The warrants are exercisable immediately with an expiry of five years and a six-month anniversary from the date of issuance at an exercise price of around $6.15 per share.

The company expects gross proceeds of $8.3 million, and the offering will close on July 21, 2021, subject to customary closing requirements. So in the coming months, DTST is a stock to watch.

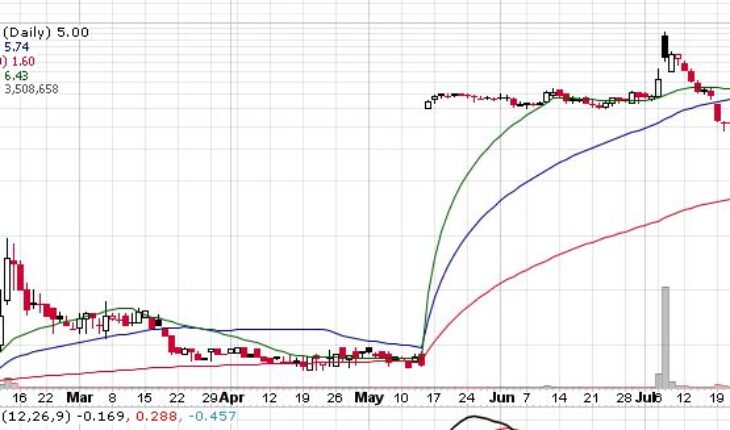

Market Reaction:

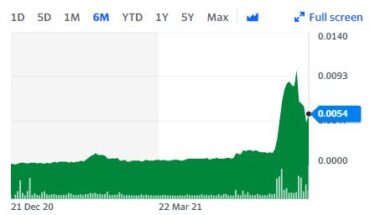

On Thursday, DTST stock surged 19.62% at $5 with more than 3.50 million shares, compared to its average volume of 1.12 million shares. The stock had moved within a range of $3.9650 – 5.5600 after opening the trade at $4.09. Over the past 52-week, the stock has been trading within a range of $0.1200 – 13.1000.