RDE Inc (OTCMKTS:RSTN) is currently best known for owning and operating the biggest restaurant based digital deals platform Restaurant.com, has been in significant focus among investors in recent days.

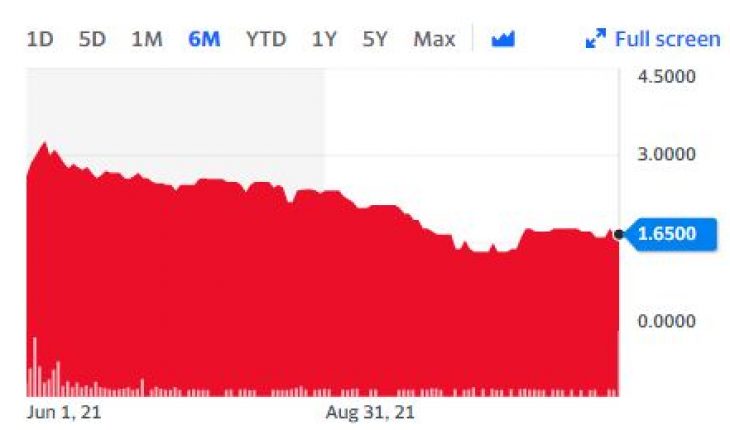

Market Action

On Tuesday, RSTN stock ended flat at $1.65 with 1 share, compared to its average volume of 826 shares. The stock has moved within a range of $1.6500 – 1.6500 after opening trade at $1.40.

Expands Travel and Entertainment Consumer Product Line

Over the course of the past week, the stock has moved upwards and managed to record gains of as much as 5%. In this situation, it might be a good idea for investors to take a closer look at the RDE stock. As it happens, the company was in focus yesterday after it announced that it had decided to expand its consumer products offerings.

RDE announced that it was now going to offer deals for such consumer items like Broadway shows, movie tickets, travel, parks, themed attractions and sports among others. In addition to that, the company also noted that more product lines are going to be added going forward. It goes without saying that it was a major announcement from RDE and could lead to considerable boost to its bottom line in the future.

The Chief Executive Officer of RDE, KetanThakker, stated, that the company has already shown its capabilities through advertising and marketing campaigns which have proved to be successful. He added that it was the right time to expand the offerings.

Key Quote

Ketan Thakker, Chief Executive Officer of RDE, Inc., stated, “We have demonstrated successful marketing and advertising campaigns through Restaurant.com connecting digital consumers, businesses, and communities offering over 200,000 dining and merchant deal options nationwide at 187,000 restaurants and retailers to over 7.8 million customers, all of which have expressed their pleasure to us and have been vocal in seeking new opportunities from businesses. We believe this is an opportune time to expand our offerings due to the continued opening of businesses throughout the U.S. in the aftermath of Covid.”

Traders Note

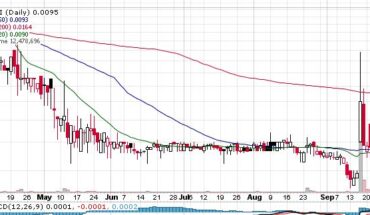

RSTN stock is trading below the 20-Day and 50-Day Moving averages of $0.1.70 and $1.65. Moreover, the stock is trading is the oversold zone with RSI stands at 48. Pivot points are $1.2333, 1.3167, 1.4833.