The past week has been a bit of a rollercoaster ride for investors in the BioElectronics Corporation (OTCMKTS:BIEL) stock. Yesterday, the stock came into focus among investors and ended the day with gains of 5%.

Market Action

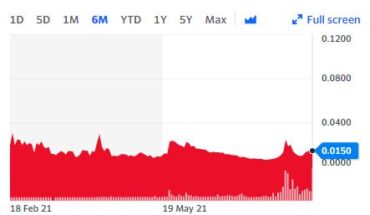

On Monday, BIEL stock moved up 4.76% to $0.0011 with 76.13 million shares traded, compared to its average volume of 27.97 million shares. The stock has moved within a range of $0.0010 – 0.0012 after opening trade at $0.0010.

Announces Major Lenders Forgoing Interest for a 3rd Consecutive Year; New Research Projects Underway

However, at the same time, it should not be forgotten that the rally on Monday was more of a recovery and the stock still remains down by 8% over the past week. However, considering the fact that the stock managed to make a recovery, It may be a good time for investors to take a look at the developments from yesterday.

The company announced yesterday that the managers of St John’s LLC and Ibex LLC, two of the biggest lenders to BioElectronics, have reached an agreement to forego the interest that had become due on their convertible notes.

It was the third year in a row in which the two lenders have decided to forego their interest payments. Hence, it is no surprise that it led to a significant degree of excitement about the stock among investors yesterday. At this point in time, it might be a good idea to add BioElectronics to your watch lists and keep an eye on the price action.

Key Quote

Kelly Whelan, President & CEO of BioElectronics, stated: “It is the goal of both the BioElectronics’ management team and the Whelan family to bring the Company to sustained profitability as quickly as possible, for the benefit of all shareholders. The Whelan family has collectively forfeited interest in excess of $1.5 million during 2020 and 2021 and will extend forbearance of interest through at least 2022.”

Traders Note

BIEL stock is trading below the 50-Day and 200-Day Moving averages of $0.0012 and $0.0023. Moreover, the stock is trading is the neutral zone with RSI stands at 46.