Yesterday, it was the Mako Mining Corp (OTCMKTS:MAKOF) (CVE:MKO) stock which had emerged as one of the major movers in the market and ended up with gains of as much as 6% as investors moved in on it in a big way.

Market Action

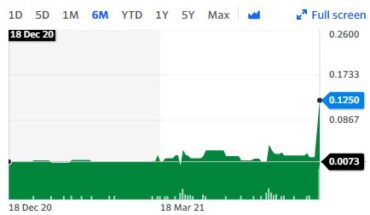

On Wednesday, MAKOF stock gained 6.65% to $0.2790 with 236k shares, compared to its average volume of 121K shares. The stock has moved within a range of $0.2727 – 0.2900 after opening trade at $0.2727.

Mako Mining Provides Q4 Production Results

In this situation, it could be necessary for investors to consider taking a look at the announcement from Mako Mining yesterday with regards to its production results for the fourth fiscal quarter of 2021. The production results in question were from the mining activities that had been conducted at the San Albino gold mine that is located in the Northern Nicaragua region.

The company announced that it had mined as much as 44160 tonnes in the fourth quarter and managed to produce as much as 12150 ounces of gold, which had a blended grade to the tune of 8.63 grams/tonne. In addition to that, 38313 tonnes had also been milled and that contained as much as 1110 ounces of gold.

It is clear to see that it was a significant announcement from the company and the excitement among investors was perhaps understandable. It now remains to be seen if the stock can continue to hold on to its momentum today or not.

Key Quote

Akiba Leisman, Chief Executive Officer of Mako states that, “this quarter was the second full quarter of commercial production at San Albino. The mine is performing well and the mill has been debottlenecked. The mill has now averaged nameplate capacity of over 500 tonnes per day for the quarter, which is a 15% improvement over the previous quarter including mill availability (38,313 tonnes milled in Q4 vs. 33,441 total tonnes milled in Q3). Replenishment of spare parts and minor adjustments to the plant are expected to further improve mill availability for the first quarter of 2022 and beyond. Over 10,000 ounces were recovered in Q4 2021, with 9,588 ounces sold during the quarter and the balance sold early in January. Operating cash flow from the mine is robust, with exploration expenditures increasing, payables now fully normalized from elevated levels during ramp-up, and approximately US$4.5 million of principal being repaid since the end of Q3.”

Traders Note

MAKOF stock is trading below the 20-Day and 50-Day Moving averages of $0.2833 and $0.2918. Moreover, the stock is trading is the neutral zone with RSI stands at 48.