Following were top five stock which were under pressure on Wednesday. Keep an eye on these stocks this week as we may some value buying at a lower level.

Looking to discover a stock ahead of the crowd? Research this.

Rogue Baron plc (OTCMKTS:SHNJF) is a premium liquor brand developer that is angling to become the next multi-million dollar buyout success story. Its award–winning Shinju Japanese Whiskey may be the best opportunity to attract one of the majors like Diageo plc or Constellation Brands. SHNJF is still rather unknown stateside. Take advantage of arbitrage opportunities by starting your research today on SHNJF

Medicine Man Technologies Inc. (OTCMKTS:SHWZ) stock was one of the biggest losers in the previous trading session as the stock fell 0.60% to $1.74 with over 109k shares traded hands, compared to its average volume of 66k shares.

Recently, the company closed the transaction to acquire the assets of Brow 2, LLC, located in Denver, Colorado. The planned transaction includes a 37,000 square foot building and equipment designed for indoor cultivation.

Texas Mineral Resources Corp. (OTCMKTS:TMRC) stock continued to trend lower on Wednesday. On Wednesday, the stock was down 4% at $1.94 with more than 95k shares traded hands, compared to its average volume of 153K shares.

Texas Mineral Resources Corp. acquires, explores, and develops mineral properties in the United States. It primarily holds interests in the Round Top rare earth-uranium- project covering 950 acres in Hudspeth County, Texas.

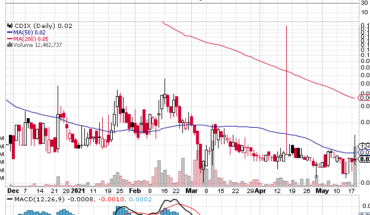

Sysorex Inc. (OTCMKTS:SYSX) stock was under pressure in previous trading session as the stock ended lower by 12.40% to $0.0700 with over 2.2 million shares traded hands, compared to its average volume of 607K shares.

Earlier this month, the company announced that it plans to sell certain assets to another company in exchange for equity valued significantly higher than the Company’s market capitalization.

Aqua Power Systems Inc. (OTCMKTS:APSI) stock was in action in the previous trading session as the stock ended lower by 15.60% at $0.1950 with over 711K shares traded hands, compared to its average volume of 191K.

The company announced that Company management is engaged in active discussions with several potential target merger and acquisition candidates. Discussions are active and ongoing with in person meetings being scheduled.

Santo Mining Corp. (OTCMKTS:SANP) stock continued to trend lower on Wednesday. On Wednesday, the stock was down 5% at $0.0010 with more than 149.81 million shares traded hands, compared to its average volume of 101 million shares. Over the past 52-week, the stock has been moving in a range of $0.0002 – 0.0055.

Santo Mining Corp., doing business as Santo Blockchain Labs, operates as a vertically integrated blockchain and cryptocurrency development company in Vietnam and the Republic of Panama.