Green Impact Partners Inc (OTCMKTS:GIPIF) on April 22, 2022, announced the filing of fiscal 2021 year-end results on SEDAR. The company presented a year of growth as well as execution with operational updates and financial results.

During the entire year, GIP continued focusing on stakeholder return. Even though there were business risks, the company made much progress with robust results.

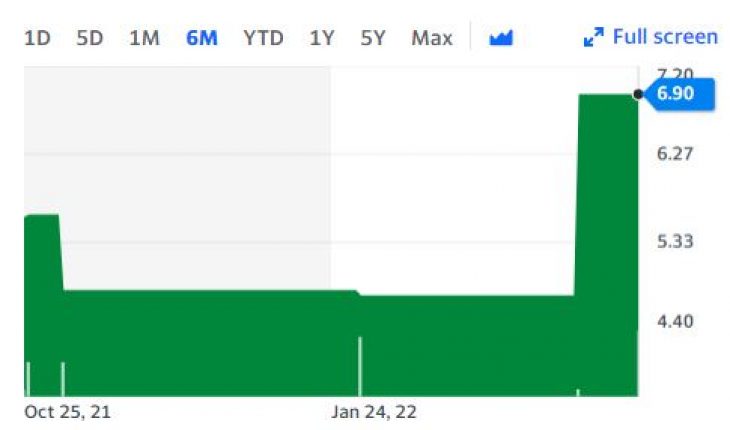

Market Action

On Friday, GIPIF stock ended flat at $6.90 with 117 shares, compared to its average volume of 34 shares. The stock moved within a range of $6.90 – 6.90 after opening trade at $6.90.

Key Details

Jesse Douglas, Chief Executive Officer, and Director of Green Impact Partners said that the drive to give results and value for stakeholders is demonstrated through a balanced approach and the ability to grow the EBITDA. Douglas added that the firm has grown the development portfolio and reduced risk by expanding senior leadership for preparing the sustained increase in net earnings.

In 2021, the Colorado RNG project received complete funding and is under construction. The company is also developing North America’s largest carbon negative RNG project while it prepares for additional RNG projects in southern Alberta and Iowa. The firm expanded the development pipeline in clean energy during the same year.

Douglas further said that the firm has made much progress in the first year as a public company. He added that it is a young and ambitious company looking to capitalize on the incredible growth in the RNG sector.

Key Quote

“The drive to provide value and results for all our stakeholders is shown through our balanced approach and ability to grow our EBITDA,” said Jesse Douglas, Chief Executive Officer and Director of Green Impact Partners. “We have substantially grown our best-in-class development portfolio, and mitigated risk by expanding our senior leadership team to prepare for the anticipated substantial and sustained increases in our top line revenue, EBITDA and net earnings as our portfolio achieves operational status.”