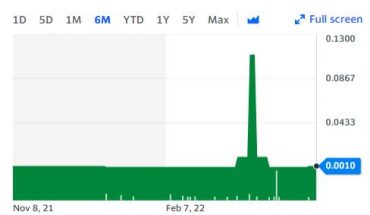

Over the course of the past week, the Eskay Mining Corp (OTCMKTS:ESKYF) stock did not have a particularly great time in the markets and ended up with a decline of as much as 13% amidst a selloff. In this situation, it may be important for investors to figure out if the stock is going to continue to slide or if a recovery might be around the corner.

Market Action

On Monday, ESKYF stock fell 2.20% to $1.76 with 111K share, compared to its average volume of 83K shares. The stock moved within a range of $1.6780 – 1.8100 after opening trade at $1.81.

Eskay Mining Closes Final Tranche of Non-Brokered Flow-Through Private Placement

As it happens, the company was in fact in the news yesterday after it announced that the last tranche of its private placement was closed and it managed to raise as much as $7 million in total. The placement was of a non-brokered nature.

The company announced that it offered as many as 1,555,557 flow through units in the final tranche for the price of $3.15 for each Charity FT unit and managed to raise as much as $4,900,004.55. The company announced that the proceeds from the private placement are going to be deployed towards taking care of exploration expenses in Canada.

While the stock has performed poorly over the course of the past week, it is going to be interesting to see if it can actually bounce back in the coming days.

Traders Note

ESKYF stock is trading below the 20-Day and 50-Day Moving averages of $1.92 and $2.14 respectively. Moreover, the stock is trading is the neutral zone with RSI stands at 36.