Yesterday, Bimini Capital Management Inc (OTCMKTS:BMNM) was in the news cycle after it announced its financial results for the fiscal quarter that had ended on March 31, 2022.

Market Action

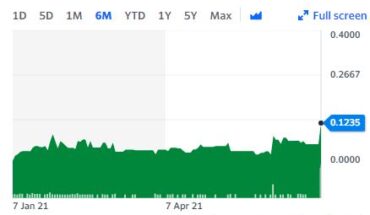

On Thursday, BMNM stock ended flat at $1.75 with 41.5K shares, compared to its average volume of 3.6K shares. The stock moved within a range of $1.7500 – 1.7500 after opening trade at $1.80.

Earnings Recap

The company announced that it had suffered a net loss of $3.5 million and that worked out to losses of $0.03 a share. The book value for each of its shares stood at $2.27 for the quarter. In this regard, it should also be noted that the management at Bimini is going to have a discussion with regards to the financial results at a conference call that is going to commence today at 10 in the morning Eastern Time.

In this context, it is also necessary to note that the Bimini Capital stock might also come into focus among investors this morning and hence, it may be a good move to keep in your watch lists at this point. The Chief Executive Officer and Chairman of the company Robert E Cauley spoke about the financial results as well.

He noted that the first fiscal quarter had proven to be hugely volatile due to the abrupt pivot from the Federal Reserve. It will be interesting to see how the stock performs in the coming days.

Key Quote

Commenting on the first quarter results, Robert E. Cauley, Chairman and Chief Executive Officer, said, “The first quarter of 2022 was extremely volatile as the Federal Reserve (the “Fed”) pivoted quickly from unprecedented monetary policy accommodation to the rapid removal of the accommodation. The Fed announced their first rate hike of the cycle at their March 2022 meeting of 25 basis points and last week announced another hike, this time of 50 basis points and stated 50 basis point hikes were on the table for the June 2022 and July 2022 meetings as well. Current market pricing in the futures markets implies the Fed will raise the target for the Fed Funds rate to approximately 2.70% by the end of 2022 and to slightly over 3.00% by the second quarter of 2023.”