Rennova Health, Inc. (OTCMKTS:RNVA) ended on a positive note for the first time in ten sessions today.

Market Action

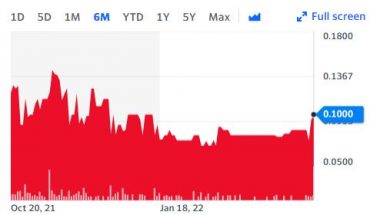

RNVA traded higher Tuesday closing the day at 0011 up .0004 gaining 57% . Today’s close ended a nine day slide. Volume was a very heavy 7.9 billion shares more than 20 times its 30 day trading volume. Over 6,000 trades took place. Investors will be looking to see if RNVA can string together a few winning days in a row. Something that hasn’t happened since February.

Rennova Health, Inc. (OTCMKTS:RNVA) filed an 8K after market hours Tuesday.

8K Highliights

Item 8.01. Other Events

As a result of conversions of shares of Series M Convertible Redeemable Preferred Stock and shares of Series N Convertible Redeemable Preferred Stock of Rennova Health, Inc. (the “Company”), the Company currently has 5,587,901,679 shares of common stock issued and outstanding. The Company is authorized to issue 10,000,000,000 shares of common stock. The Company expects it will exhaust all of its authorized shares of common stock in the immediate future. It will not then be able to issue additional shares of common stock unless and until it is able to amend its Certificate of Incorporation to increase its authorized common stock or it effects a reverse split. The Company needs immediate additional capital to execute on its business plan and without the ability to issue shares of common stock will have difficulty securing the capital required to continue in business.

On April 22, 2021, the Company entered into agreements with certain institutional investors for warrant prepayment promissory notes in the aggregate principal amount of $220,000. The Company received proceeds of $200,000. All or any portion of the principal amount of these notes may be applied, at the option of the payees, to the exercise price of any common stock purchase warrants held by the payees. The notes are unsecured and mature in one year. They do not bear interest but an interest rate of 18% will be applied commencing five days after any event of default that results in acceleration of the notes.

RNVA has been on a long slide losing 99% of its value since last summer. While it seems highly unlikely old shareholders will ever see the glory days again there may be some upside here if buyers can put together a few winning days in a row. Keep RNVA on your watchlist to see if it happens.