Blueknight Energy Partners LP (NASDAQ:BKEP) is moving higher a bit the pre-market session after the news.

Market Action

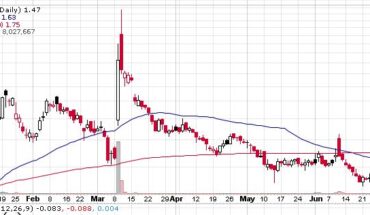

As of 7:53, BKEP stock increased 0.25% to $4.05 on low volume of 100 shares. The stock has gained almost 230% from its 52-week high of $1.20.

Blueknight Announces Closing of New $300 Million Revolving Credit Facility

- announced today that it has closed a new four-year, $300.0 million senior secured revolving credit facility (the “New Credit Facility”). The New Credit Facility will replace the previous credit facility which was set to mature in May 2022.

- The relevant terms and covenants contained in the New Credit Facility are summarized below (as compared to the previous credit facility):

- Credit Facility Size: permits borrowings up to $300.00 million ($50.0 million lower) with a provision to increase total commitments up to aggregate maximum of $450.0 million, Interest Rate: LIBOR plus applicable margin ranging from 2.00% to 3.25% (no change);

- based on first quarter 2021 total leverage ratio of 2.12 times, the opening applicable margin remains at 2.00%, Maximum Total Leverage Ratio Covenant: 4.75 times (no change), Minimum Interest Coverage Ratio Covenant: 2.50 times (no change)

“We are very pleased with the successful execution and outcome of our new credit facility,” said Andrew Woodward, Chief Executive Officer. “The extension represents another critical step forward in Blueknight’s transformation, as it strengthens our liquidity position and enhances our visibility into our cost of capital through May 2025 while maintaining financial flexibility for future growth. We are grateful for the continued support from our existing lending partners and are pleased to welcome several new participants to the lender group.”