Progenity, Inc (NASDAQ:PROG) is moving lower in the pre-market session after the news on Wednesday. The stock went up 10.42% on Tuesday as well.

Progenity Launches Strategic Transformation into Biotech Company, Eliminating Costs of Progenity Genetics Lab and Focusing on Robust, Innovative R&D Pipeline

- announced a transformation strategy that will focus the company primarily on its robust R&D pipeline and better position the business for future growth. To achieve this vision, simplify its business model, and unlock shareholder value, the company will seek to reallocate resources to R&D and materially reduce operating expenditures by approximately 70%.

- Cost Realignment. Progenity will discontinue providing genetic laboratory-developed test services through its Ann Arbor, Michigan CLIA-certified laboratory and cease offering its Preparent® Carrier Test, Innatal® Prenatal Screen, Riscover® Hereditary Cancer Test, and Resura® Prenatal Test.

- Opportunities for Non-Dilutive Capital Infusion. Progenity’s in-network affiliate lab, Avero Diagnostics, is approaching operating profitability, with growing revenues projected to be $35-40 million for 2021 derived from anatomic pathology, genetic testing and infectious diseases. Progenity is evaluating strategic opportunities for Avero to generate non-dilutive capital that may help fund the company.

- Focus on Innovation. Progenity’s continuous pursuit of innovative solutions seeks to provide near-term commercial applications while also developing the drug delivery systems of the future, with critical near-term milestones across its PreecludiaTM pre-eclampsia rule-out test, Drug Delivery System (DDS) platform, and Oral Biopharmaceutical Delivery System (OBDS).

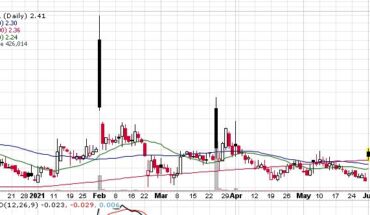

Market Action

As of 8:18, PROG stock moved down $0.12 or 4.20% to $2.74. So far the stock has traded 7.3K shares traded hands. The stock has been underperforming the broader market so far this year with a fall of 46%.