The Zomedica (NYSEAMERICAN:ZOM) stock has had a pretty remarkable ride this year that saw the stock going from 25 cents a share to more than $2 a share in February.

However, the stock eventually corrected and is now trading at 85 cents a share. Like many other penny stocks, the Zomedica stock has been quite volatile but unlike most penny stocks it is a pretty liquid stock due to high trading volumes.

However, it should be noted that at this point the stock is overvalued and the company needs to show considerable growth if the stock price is to be justified.

Greg Blair was recently hired as the vice president of business development and is expected to be involved in the commercialisation of Truforma, the company’s diagnostic platform for cats and dogs. Zomedica has also moved to a direct sales operation and discontinued its distributor fuelled efforts. However, up until tangible growth is visible, it might be a good idea to stay on the sidelines.

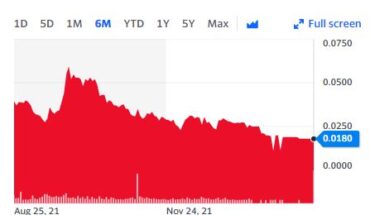

Market Action

ZOM stock closed higher by $2.99% to close at $0.8485. Total volume was 53.33 million shares, compared to its 30-day average volume of 62.46 million shares. The stock moved within a range of $0.8100 – 0.8610after opening at $0.825. Over the past year, the stock has moved up 423%. The stock is trading near to the neutral zone as RSI stands above 46.