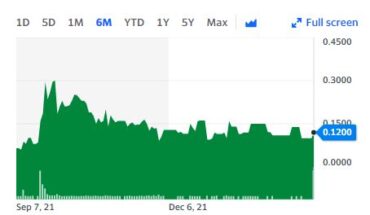

Inhibikase Therapeutics Inc (NASDAQ:IKT) stock continues to slide in the pre-market session on Wednesday after falling 17% in yesterday’s trading session. The stock is down 42% YTD.

Major Trigger:

Inhibikase Therapeutics Prices Follow-On Public Offering of Common Stock

Key Highlights:

- Inhibikase Therapeutics announced the pricing of an underwritten public offering of 15 million shares of its common stock at a public offering price of $3.00 per share for total gross proceeds of approximately $45 million (the “Offering) before deducting underwriting discounts and commissions and offering expenses payable by Inhibikase.

- In addition, Inhibikase has granted the underwriters a 45-day option to purchase up to 2.25 million additional shares of common stock at the public offering price, less underwriting discounts and commissions. The offering is expected to close on June 18, 2021, subject to customary closing conditions.

- Inhibikase intends to use the net proceeds from the public offering, together with existing funds, to fund the costs of a Phase 1b extension study for IkT-148009 in Parkinson’s patients and to validate target engagement markers in the central and peripheral nervous system; to fund production of IkT-148009 for Phase 1b and Phase 2 clinical studies and to fund a Phase 2 efficacy trial of IkT-148009 in Parkinson’s patients.

- This funding will further support the clinical dose calibration study(ies) of IkT-001Pro in healthy subjects to support approval under the Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act and to fund drug product production for IkT-001Pro. The balance will support general research and development activities, medicinal chemistry for additional molecules and IND-enabling studies, team building, and other general corporate activities

Market Reaction

As of 6:40, IKT is trading at $3.04, down 24.41%. So far more than 434K shares have exchanged hands.