Renova Health (OTCMKTS:RNVA) had a forgettable time last week in the markets as it tanked by as much as 28% for the week. On Friday alone, the stock declined by 17%.

While it is true that there was no specific news with regards to the company last week, it might still be useful if investors consider taking a look at a development from earlier on this month. The company, which owns and operates hospitals in rural Tennessee, had announced earlier on this month that it continues to work on an agreement it signed with VisualMED Clinical Solutions Corp.

As per the provisions of the agreement signed between the two parties, two divisions of Renova Health, Advanced Molecular Services Group Inc and Health Technology Solutions Inc are going merged with VisualMED. Advance Molecular is involved in genetic testing interpretation and Health Technology Solutions is engaged in software.

It is also necessary to point out that the subsidiaries of these two business divisions are also going to be merged with VisualMED. Once the transaction is completed, the two divisions and its subsidiaries are going to operate as fully owned subsidiaries of VisualMED. In the meantime, it is going to be interesting to see if the stock actually recover this week.

Market Reaction:

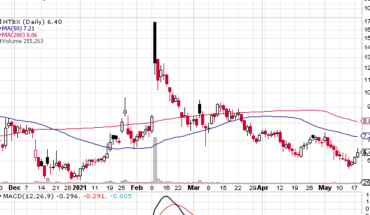

On Friday, RNVA stock fell by 16.67% to $0.0057 with more than 550.99 million shares, compared to its average volume of 276.31 million shares. The stock has moved within a range of $0.0004 – 0.0006 after opening the trade at $0.0006. Over the past 52-week, the stock has been trading within a range of $0.0004 – 3.0000.

Pivot Points

| Name | S3 | S2 | S1 | Pivot Points | R1 | R2 | R3 |

| Classic | 0.0002 | 0.0003 | 0.0004 | 0.0005 | 0.0006 | 0.0007 | 0.0008 |

| Fibonacci | 0.0003 | 0.0004 | 0.0004 | 0.0005 | 0.0006 | 0.0006 | 0.0007 |

| Camarilla | 0.0004 | 0.0005 | 0.0005 | 0.0005 | 0.0005 | 0.0005 | 0.0006 |

| Woodie | 0.0003 | 0.0003 | 0.0005 | 0.0006 | 0.0007 | 0.0008 | 0.0009 |

| DeMark | – | – | 0.0003 | 0.0005 | 0.0006 | – | – |