Ideanomics (NASDAQ:IDEX) has recently tried to find a footing, and although the penny stock has been struggling, it is 44% up year to date and over 600% in the past year. However, the stock is 50% for the 52-week highs, implying a mixed picture regarding IDEX. In mid-February, shares peaked, which was almost the same time other high-growth and speculative stocks surged.

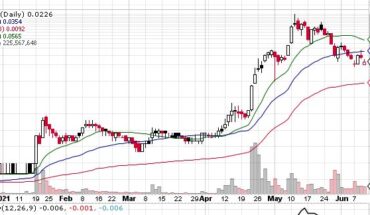

Although IDEX has shown potential, even rallying 1,200% at some point over the past 12 months, the current bear market has been a reminder of how things change quickly. The stock gave a double-bottom at $2.25 but held up above its 200-day moving average and then later pushed through the 50-day moving average and downtrend resistance. The stock topped up $5.5 before dropping in February, with $3.5 failing to act as support.

Ideanomic has been running into issues, and the stock is highly speculative. In the coming weeks, this is a stock to watch.

Market Reaction:

On Friday, IDEX stock fell 0.32% to $3.09 with more than 66.77 million shares, compared to its average volume of 20.77 million shares. The stock has moved within a range of $3.0600 – 3.1700 after opening the trade at $3.11. Over the past 52-week, the stock has been trading within a range of $0.8000 – 5.5300.