AST SpaceMobile Inc (NASDAQ:ASTS) is one of the notable gainer in Wednesday’s trading session as investors reacted positively to a bullish analyst report from Deutsche Bank, who sees 242% upside from yesterday’s closing price. The stock has already doubled over the past month.

Analyst Bryan Kraft commented, “We are initiating coverage of AST SpaceMobile with a Buy rating and a $35 price target, which represents more than 3x the current stock price. Our PT is based on an average of four model scenarios, and implies EV/EBITDA multiples of 20x 2024E and 6x 2025E. If management executes on plan over the next 4-5 years, we see intrinsic value ultimately being significantly higher than our $35 PT reflects.

Given management’s projections for $1B in 2024 EBITDA, $2.6B in 2025, and $16B in 2031, a 6x multiple in 2025 would be extremely low for such a high forward growth outlook. However, the stock could also end up being worth $0 if AST’s technological solution to enable satellites to communicate directly with smartphones doesn’t work or scale as intended, or if the company’s very large (24m x 24m) arrays do not unfold in space as they are designed to.”

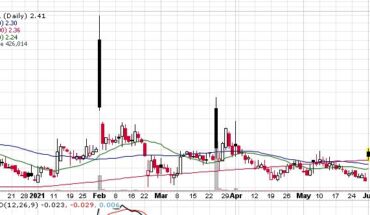

Market Reaction:

As of 12:01, ASTS stock soared 39.37% to $14.23 with more than 31.23 million shares, compared to its average volume of 2.26 million shares. The stock has moved within a range of $ 12.51 – 15.47 after opening the trade at $13. Over the past 52-week, the stock has been trading within a range of $6.96 – 25.37.