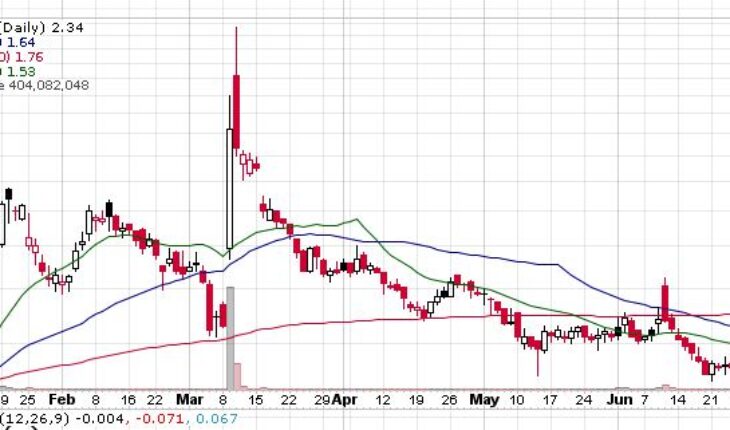

The Exela Technologies (NASDAQ:XELA) stock experienced heavy action on Tuesday and soared by as much as 59% on the back of massive volumes. The massive rally in the stock came about after a phase of consolidation during the course of which more than 70% of the Exela market cap had been lost.

Back in March, the stock had hit its peak of $7.82 a share but eventually it corrected sharply. However, the rally on Tuesday was not by any fundamental change in the company’s business. It appears that the stock is now the target of the retail investors who have identified it as a potential candidate for a short squeeze move.

As a matter of fact, once you look at the numbers it becomes fairly obvious why the Exela stock might have become a target for such a move. At this point in time, the short volume ratio in the stock stands at as much as 25%.

However, it should be noted that yesterday the company announced that is robotic process automation platform named EON as rolled out for a big health insurance company. That might have been another factor behind the optimism in the Exela stock among many investors.

Market Reaction:

On Tuesday, XELA stock soared 59.18% to $2.34 with more than 404.16 million shares, compared to its average volume of 2.49 million shares. The stock has moved within a range of $1.8800 – 2.5800 after opening the trade at $2.22. Over the past 52-week, the stock has been trading within a range of $0.9900 – 7.8200. Moreover, the stock is up another 17.50% to $2.75 in the pre-market session.