On Tuesday, the ParkerVision Inc (OTCMKTS:PRKR) stock was in the middle of a bit of a slump and ended the day with a decline of as much as 3%.

Market Action

On Tuesday, PRKR stock fell 3.17% at $1.22 with more than 41k, compared to its average volume of 41k shares. The stock has moved within a range of $1.1800 – 1.2600 after opening the trade at $1.26.

Receives Favorable Markman Recommendations in ParkerVision v. Hisense and TCL

The company announced yesterday that the Judge Alan Albright appointed Special Master for the United States District Court for the Western District of Texas provided his recommendations claim constructions to the court in relation to the patent infringement actions that had been brought by ParkerVision against some companies. The patent infringement claims had been brought by the company against TLC Industries Holdings Co Ltd, TCL Electronics Holdings, Schenzhen TCL New Technology, TCL Moka Manufacturing, TCL King Electrical Appliances (Huizhou) Co Ltd, TCL Moka Int’l Ltd and Hisnese Co Ltd.

The constructions recommended by the Special Master have adopted the proposed constructions from ParkerVision for as many as twenty from out of the twenty three terms. In addition to that, it should be noted that the construction are in line with the previous recommendations from the District Court in the matter of ParkerVision v Intel. Although the stock did fall yesterday, it is going to be interesting to see if the stock can actually make a comeback through the rest of the week.

Key Quote

Jeffrey Parker, Chairman and Chief Executive Officer of ParkerVision stated, “We are pleased with the Special Master’s claim construction recommendations and appreciate the continued efficiency of the Texas court system and the pace at which the court has been moving our cases through the litigation process.”

Traders Note

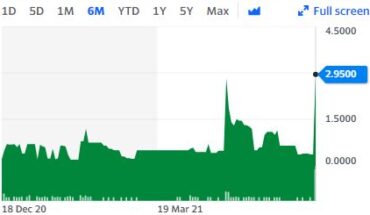

PRKR stock is trading below the 200-Day and 20-Day Moving averages of $1.30 and $1.22 respectively. Moreover, the stock is trading below the 20-Day moving average of $1.24. The stock is up 154% so far this year.