Over the past week, the Liberty Star Minerals (OTCMKTS:LBSR) stock has been in the middle of a steady selloff but on Monday it made a bit of a recovery and ended the day with gains of 3%.

Market Action

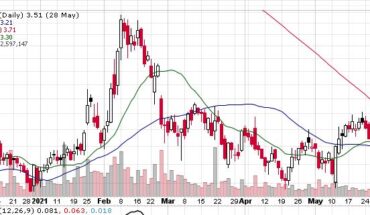

On Monday, LBSR stock gained 3.50% at $0.50 with more than 130k, compared to its average volume of 15k shares. The stock has moved within a range of $0.4400 – 0.5065 after opening the trade at $0.4828.

Presents Fire Assay Results from the Red Rock Canyon Gold Project

However, at the same time, it is necessary for investors to keep in mind that over the course of the past week the stock is still down by as much as 10%. In this context, it might be a good idea to take a closer look at the update that had been provided by Liberty Star Minerals on Monday.

Yesterday, the company provided an update with regards to its Red Rock Canyon Gold Project in Arizona. The project is owned in its entirety by Liberty Star Minerals. On Monday, the company presented the fire assay results from for determining the presence of gold at the property. In order to accomplish that, the company sent as many as 28 samples from the Red Rock Canyon Gold Project to ALS Laboratories, which is based out of Tuscon.

The update seemed to have come as a boost for shareholders and it is going to be interesting to see if the stock can manage to add to its gains today.

Key Quote

States Liberty Star CEO Brett Gross: “The June 2021 technical report called our Red Rock Canyon Gold Project ‘a property of merit that warrants further evaluation.’ That is exactly what we are doing. Rock chip geochemical results keep affirming the historic results showing attractive gold grades. A drilling program, detailed geologic mapping, and Induced Polarization (IP) surveys are part of our efforts to see about potential deposit definition.”

Traders Note

LBSR stock is trading below the 20-Day and 50-Day Moving averages of $0.55 and $0.62 respectively. Moreover, the stock is trading below the 200-Day moving average of $1.08. The stock is down 16% over the past month.