This past Friday Can B Corp (OTCMKTS:CANB) stock was in the news after the health and wellness company announced its quarterly results for the third fiscal quarter that had ended on September 30, 2021.

Market Action

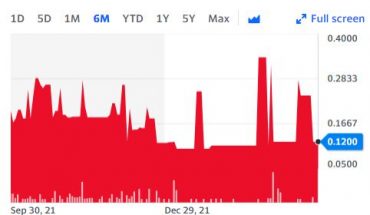

On Friday, CANB stock fell 6.65% to close at $0.56 with more than 79K shares, compared to its average volume of 59k shares. The stock has moved within a range of $0.5317 – 0.6100 after opening the trade at $0.61.

Quarterly Earnings Recap

Investors did not seem to be particularly pleased with the numbers posted by the company and ended up with a decline of as much as 7%. In this situation, it could be a good idea for investors to take a closer look at the financial results. Can B Corp posted revenues of $1.9 million in the third quarter and that worked to a year on year rise of as much as 316%.

The company went on to point out that it expected that the trend could continue in the coming quarters up until 2023 and it goes without saying that it was a significant comment. On the other hand, the gross profits generated by Can B came in at $1.4 million and that worked out to a year on year jump of as much as 261%. The total assets under the company’s control at the end of the quarter stood at $14.2 million and the stockholders’ equity also went up to hit $5.7 million.

Key Quote

Marco Alfonsi, Can B’s Chief Executive Officer, stated, “Our moves over the past few months are paying off and have put us in great position to accelerate our revenue growth and strengthen our balance sheet. We believe this quarter’s results are just the beginning as we just recently acquired these additional assets. Our team is hard at work integrating and ramping up the various operations to continue this momentum into the future. These dramatic revenue improvements, coupled with our acquisitions and asset base increases, position us solidly to continue our application process for a NASDA up listing.”

Traders Note

CANB stock is trading below the 20-Day and 50-Day Moving averages of $0.60 and $0.65 respectively. Moreover, the stock is trading below the 200-Day moving average of $0.58. The stock is down 14% so far this year.