Shares of GlobeX Data (OTCMKTS: SWISF) pulled back a bit in the previous trading session. The stock has gained 20% over the past week.

Market Action

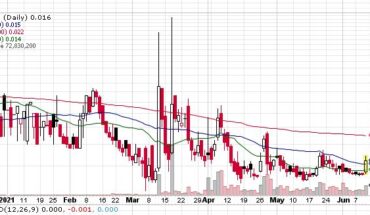

On Tuesday, SWISF stock fell 6% to $0.3757 with more than 181k shares, compared to its average volume of 185k shares. The stock has moved within a range of $ 0.3700 – 0.4189 after opening the trade at $0.82.

Latest News

GlobeX Data (OTCMKTS: SWISF) announced on November 09th that it has closed its previously announced private placement commitment after selling a whopping 4,351,260 Units for gross proceeds before banking and wiring fees of CA$ 1,740,504 (US$ 1.4 million) in equity financing in the form of Units. Each Unit of one common share is priced at CA$0.40 per share, and one-half of one share purchase warrant. If a holder has a Full Warrant, they can purchase a Common share at a price of CA$0.80 per share for a two-year term (offering closed now).

The proceeds of this financing are to be diverted towards the marketing of the company’s Sekur encrypted email and messaging solution to the US market. These funds will also be used for spreading awareness regarding company objectives as a publicly listed company, to the general public and the investment community.

Alain Ghiai, CEO of GlobeX Data says that the year is closing soon, and they are excited about beginning 2022 on a triumphant note with a solid balance sheet. He thanks shareholders and customers who are supporting the company by subscribing to SEKUR, and also purchasing their security on the Canadian, American and German stock exchanges. GlobeX’s Data privacy solutions are hosted in Switzerland, thereby keeping users’ data safe from any outside data intrusion requests.

Key Quote

Alain Ghiai, CEO of GlobeX Data said: “As we are closing the year soon, we are ready to start 2022 with a solid balance sheet. We are grateful to all our shareholders and our customers who are supporting us by subscribing daily to SEKUR, and purchasing our security on the Canadian, American and German stock exchanges. We will continue to increase our media exposure in the USA as we build our brand as a publicly listed company engaged in providing privacy and security to all our supporters and shareholders out there.”

Traders Note

SWISF stock is trading above the 50-Day and 200-Day Moving averages of $0.15 and $0.13 respectively. However, the stock is trading below the 20-Day moving average of $0.20. The stock is up 88% over the past 3-month.