Despite the decline in the Alpha Lithium Corporation (OTCMKTS:APHLF) stock on Tuesday, it may not be a bad idea for investors to keep track of the company and take a closer look at some latest developments.

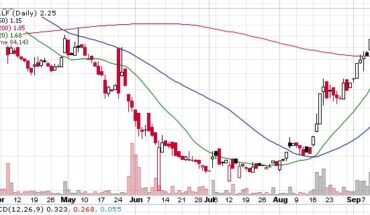

Market Action

On Tuesday, APHLF stock slid 4.30% at $1.12 with more than 1.53 million shares, compared to its average volume of 872k shares. The stock has moved within a range of $1.0300 – 1.4000 after opening trade at $1.40.

Secures US$30 million Investment from Uranium One with Right to Invest Additional US$185 million at Tolillar Salar, Argentina

Yesterday, the stock was in the middle of a selloff and ended up with a decline of as much as 4% as a consequence. In this situation, it may be a good idea for investors to look into an announcement from Alpha Lithium stock earlier on in the week on Monday. At the time the company announced that it had concluded a significant asset transaction with the company Uranium One Group.

It was a significant announcement from the company considering the fact Uranium One is an international chemical processing behemoth that is worth in billions. As per the terms of the agreement, Uranium One Holding N.V., which is a fully owned subsidiary of Uranium One Group, reached an agreement by way of which it will invest $30 million in Alpha Lithium.

In exchange, it will get a 15% stake in TollilarSalar project located in Argentina. The project is currently owned in its entirety by Alpha Lithium.

Key Quote

Brad Nichol, Alpha’s President and CEO commented, “This early-stage asset has attained a truly game-changing breakthrough for our shareholders. This sort of milestone is rarely achieved by a company with less than two years of operations and with a valuation at this level. Exercising the Earn-in Right implies a value at Tolillar of US$529 million, not including any Additional Consideration. Including the maximum Additional Consideration, the implied project value would be US$604 million, which is over CDN$750 million for the Tolillar asset alone.”