Charlie’s Holdings Inc. (OTCMKTS: CHUC) is up 17% in a week after the proprietary, nicotine-based e-cigarette sector leader announced its Q4 and FY 2020 financial results and offered an update on its corporate highlights.

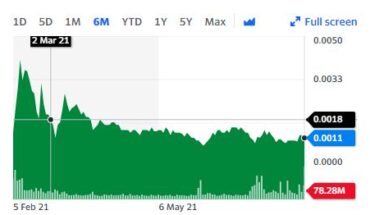

Market Action

On Tuesday, CHUC stock moved up 1% to $0.10 with 3K shares, compared to its average volume of 28.5K shares. The stock moved within a range of $0.0999 – 0.1000 after opening trade at $0.10.

Charlie’s Holdings Reports 29% Revenue Growth and a Return to Profitability

In FY 2021, the company had revenue of $21.5 million, representing a YoY increase of 29%. Gross profit was up 20% in Q4 2021 to $11.1 million, while net income was up by $12 million to $4.8 million. For the fourth quarter, the company had revenue of $6.5 million, representing a YoY increase of 47%. During the quarter, gross profit was up 47% to $3.1 million. Net income dropped by $2.1 million to around $2.1 million.

CFO Matt Montesano said that the company ended the year on a strong note. Overall, they had a fruitful year in which they saw almost 30% growth in revenue and operating profitability. The major highlight of the company’s improved operating efficiency and financial progress was reducing operating costs as a percentage of revenue. So investors should keep an eye on CHUC.

Key Quote

“We finished 2021 on a strong note and overall had a very successful year, as we returned to near 30% revenue growth and operating profitability,” reported Matt Montesano, Charlie’s Holdings, Inc. Chief Financial Officer. “Our fourth quarter performance was even stronger with 53% revenue growth and operating income of $584,000. A major highlight of our financial progress and improved operating efficiency was the continued reduction of operating expense as a percentage of revenue, which was as low as 39% for the fourth quarter. We plan to continue this trajectory and improve our capital markets positioning so that the market price of Charlie’s stock is more reflective of our business performance.”

Traders Note

CHUC stock is trading above the 20-Day and 50-Day Moving averages of $0.09 and $0.09 respectively. Moreover, the stock is trading is the oversold zone with RSI stands at 56.