Clinical-stage biotechnology company, Advaxis Inc (OTCMKTS:ADXS) on June 8, 2022, announced the financial results for quarter two ending April 30, 2022. The company also gave a business update.

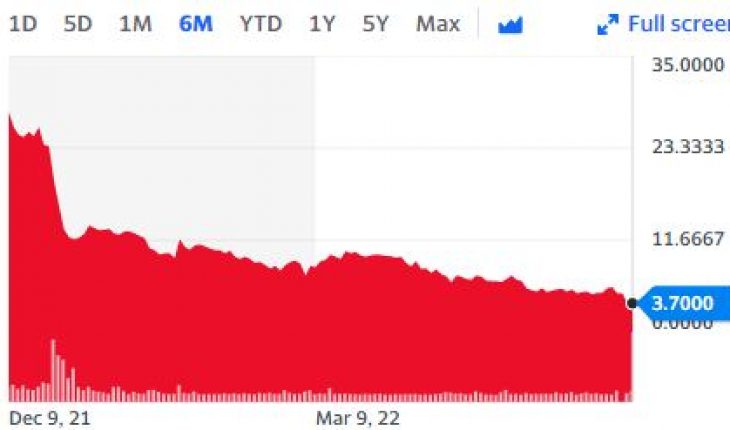

Market Action

On Wednesday, ADXS stock fell 14% to $0.0620 with 1.3 million shares, compared to its average volume of 5.99k shares. The stock moved within a range of $0.0620 – 0.0900 after opening trade at $0.0750.

Advaxis Reports Second Quarter Ended April 30, 2022, Financial Results and Provides a Business Update

In the quarter, the firm confirmed on publication of the KEYNOTE-046 study in The Oncologist. This is associated with prolonged overall survival in patients with metastatic castration-resistant prostate cancer. Amongst the upcoming milestones, the company expects to present initial clinical as well as biomarker data from the Phase 1 clinical trial of ADXS-504. It will also show additional immune correlative data from Phase 1/2 clinical trial of ADXS-503.

Kenneth A. Berlin, President, and Chief Executive Officer of Advaxis said that the company presented sound clinical results at ASCO. Berlin added that this demonstrates the benefits that some patients are experiencing in the ongoing phase 1/2 study of ADXS-503.

Berlin further stated that the company is looking at continuing enrolment of patients in part B of the study with the target of achieving 20% ORR. The CEO said that the company is controlling expenses and is foreseeing a cash runway extending into the second fiscal quarter of 2024.

Advaxis R&D expenses during quarter two of the current fiscal were $1.5 million vis-à-vis $4.3 million during the same period of last fiscal. The lower expenses were due to a substantial reduction in costs. The General and administrative expenses for three months were$1.8 million as compared to $3.4 million in 2021.

Key Quote

Kenneth A. Berlin, President and Chief Executive Officer of Advaxis said, “We presented encouraging clinical results at ASCO which demonstrate the benefits that select patients are experiencing in our on-going phase 1/2 study of ADXS-503 with pembrolizumab both in the setting of failing pembrolizumab as last therapy and in the 1st-line metastatic setting. We look forward to continuing the enrollment of patients in part B of the study with the goal of achieving the target 20% ORR and to the continued enrollment and advancement of our clinical trial of ADXS-504 in collaboration with researchers at Columbia University. In addition, we have completed the execution of the 1-for-80 reverse stock split which allows the company to pursue a return to listing on the NASDAQ.” Mr. Berlin added, “We continue to control our expenses and foresee our cash runway extending into the second fiscal quarter of 2024.”

Traders Note

ADXS stock is trading below the 20-Day and 50-Day Moving averages of $0.0667 and $0.0854 respectively. Moreover, the stock is trading is the oversold zone with RSI stands at 40.