M&F Bancorp Inc. (OTCMKTS:MFBP) is the second-oldest African American-owned bank in the US. Founded in 1907, the bank had $370 million in total assets in March 2022. The financial institution is the eighth largest African American-owned financial institution in the US. With a mission of promoting community and personal development by lending to SMEs in local communities, its particular emphasis is on the financial requirements of underserved geographies and populations.

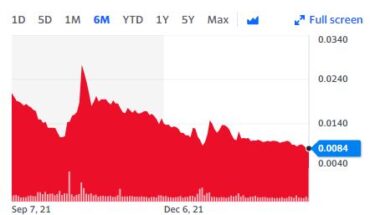

Market Action

On Friday, MFBP stock moved up 9.53% to $9.52 with 21K shares, compared to its average volume of 2.4K shares. The stock moved within a range of $8.75 – 9.49 after opening trade at $8.75.

M&F Bancorp, Inc. Receives $80 Million in New Capital Investment Funds

M&F Bancorp on June 22, 2022, had announced successfully closing an 80 million investment from U.S. Treasury as part of the Emergency Capital Investment Program. The firm has issued 80,000 shares of Senior Non-Cumulative Perpetual Preferred Stock, Series E to the U.S. Treasury in exchange for the same.

The stock, which qualifies as Tier 1 capital for regulatory purposes, has no maturity date, limited voting rights, and ranks senior to its common stock with respect to payment of dividends as well as distributions and amounts payable upon liquidation. No dividends are payable in the first and second years. Post this, noncumulative dividends are payable at a rate of 0.5% to 2.0%, with the actual rate seen during years 3-10 based on its annual qualified lending amount.

James H. Sills, III, M&F Bank’s President, and CEO said that the firm’s capital is now more than $119 million as a result of the investment. Sills added that the investment is proof of the strength of the bank’s franchise as well as the robust abilities of the company to impact disadvantaged communities within its markets.

The CEO further added that the investment will enable the company to build on recent successes by giving more ways to support small businesses. ECIP was set up for encouraging low- and moderate-income community financial institutions for enhancing their support to small consumers and businesses.

The US treasury will give about $9 billion in capital directly to institutions under the ECIP. The capital will facilitate banks to give loans to minority-owned businesses as well as consumers across North Carolina. The investment will be significant for continuing technology enhancements, providing more lending capacity as well as building relationships with financial partners. M&F Bank is committed to providing holistic financial solutions to both businesses and individuals.

Key Quote

“As a result of this investment, the Company’s capital now exceeds $119.0 million. This investment is a testament to the strength of the M&F Bank franchise, the health and soundness of the Company, and its abilities to positively impact disadvantaged communities within its markets,” commented James H. Sills, III, M&F Bank’s President, and CEO. “This investment will allow us to build on our recent successes by providing even more ways for us to support small businesses in our community.”

Traders Note

MFBP stock is trading above the 20-Day and 50-Day Moving averages of $7.03 and $7.08 respectively. Moreover, the stock is trading in the oversold zone with RSI stands at 80.