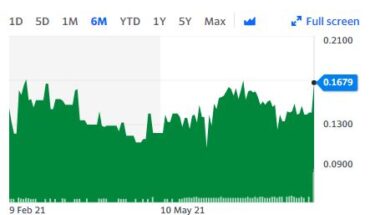

Ring Energy Inc (NYSEAMERICAN:REI) is trading slightly lower in the pre-market session, cooling off a bit after a 22% surge in the past two weeks.

Major Trigger:

Ring Energy Executes Targeted Hedging Transactions to Further Increase Free Cash Flow Generation in 2021

Key Highlights:

- today provided an update on its derivate positions for 2021 and 2022 as it opportunistically responds to an improved crude oil price environment.

- Bought back a 1,500 barrels of oil per day (“Bbl/d”) call option for June 1 through December 31, 2021, and entered into an approximate 879 Bbls/d calendar 2022 swap contract for no net cost;

- Anticipate more than 320,000 barrels of crude oil sales for June 1 through December 31, 2021, to be realized at a higher level than the $55.35 per barrel ceiling price previously in place;

- Additionally, the 2022 swap position is priced higher than the $45.66 per barrel collective average price previously in place; and

- Expected increase to cash flow from higher realized pricing in 2021 will primarily be used to further pay down debt.

Key Quote from

Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer, commented, “When we entered into contracts to substantially fill our hedge book for expected 2021 production in late fall of last year, we were operating in a backdrop of $45 per barrel WTI primarily due to the economic impacts of COVID-19. Moving into our fall bank redetermination process, our hedging strategy was appropriately designed to lock in 2021 pricing that fully funded our targeted work program while guaranteeing the necessary cash flow to pay down debt. Substantially driven by the dramatic improvement in economic activity with the worldwide recovery from COVID-19, there has been an almost 50% increase in WTI crude oil pricing over the past six months. This much-improved price environment has allowed us to pivot to a more opportunistic hedging strategy.

Market Reaction

As of 8:33, REI is trading at $2.72, down 0.37%. So far more than 1K shares have exchanged hands.