Build-A-Bear Workshop Inc.(NYSE: BBW) stock surged 9.1% after the company reported strong Q1 revenue and topping earnings estimates. The company posted earnings of $0.6 per share in the quarter, topping the Zacks Consensus estimates of a $0.53 loss per share.

Build-A-Bear saw 96.7% growth in revenue

Revenue was up 96.7% to $91.69 million, beating consensus estimates of $48.74 million thanks to e-commerce sales. Ecommerce sales were up 87% YoY, with the international franchise and commercial revenues being $2.5 million, up from $1 million a year ago.

Sharon Price John, the company’s CEO and the president, said that the company had one of the strongest quarters in its nearly 25-year history with 96.7% growth in revenues. She said significant growth for both digital channels and brick-and-motor stores despite European locations temporarily closing for a long duration due to COVID-19 restrictions.

Build-A-Bear expects revenue of $39.69 million in Q2

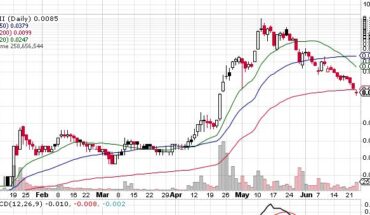

Build-A-bear had outperformed the market this year, and for investors, the question is whether the stock will sustain this momentum. To address this, investors should look at its outlook, which includes current consensus earnings expectations for the subsequent quarter and how the expectations have changed. It will be fascinating to see how then estimates change for the current fiscal year and coming quarters. The current consensus revenue estimate is $39.69 million and EPS of -$0.19 for the second quarter.

For fiscal 2021 the company anticipates revenue of $262.8 million with an EPS of $0.33. In Q2, Build-A-Bear expects e-commerce demand to be flat compared to last year, but that could be triple what the company reported in 2019. For investors, they need to be mindful that the industry outlook can impact the stock performance as well as the company’s outlook.