A reverse stock split may help a company with some of its problems but it is almost always bad news for the stock and that is what seems to have happened with the Renova Health (OTCMKTS:RNVA) stock. On Monday, the Renova stock was in the middle of a strong downward spiral and tanked by as much as 50%.

The decline in the stock is almost certainly in reaction to the announcement from the company on Friday that it was going to have a 1 for 1000 reverse stock split. The stock is going to start trading on split adjusted basis from July 19, 2021. However, at the same time, it should be noted that it is going to be effective from 5 p.m. Eastern Time on July 16, 2021.

After the reverse stock split is completed, each block of 1000 shares in Renova is going to be turned into 1 share of the common stock. That being said, it is also necessary to point out that the reverse stock split is not going to bring about any chance in the nominal par value per share of the Renova stock, which is going to stay at $0.0001.

Market Reaction:

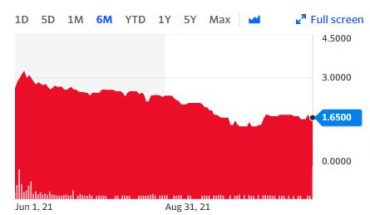

On Monday, RNVA stock slumped 50% at $0.0003 with more than 1.06 billion shares, compared to its average volume of 303.27 million shares. The stock had moved within a range of $ 0.0003 – 0.0005 after opening the trade at $0.0004. Over the past 52-week, the stock has been trading within a range of $0.0003 – 3.0000.